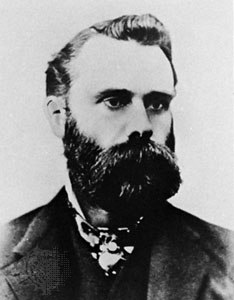

Charles Henry Dow (1851-1902)

On July 3 1884 Charles Henry Dow together with his colleague Edward Jones composed and published an stock average – called the Dow Jones Railroad Average -, which contained nine railroads and two industrial companies. He developed the stock index as part of his market research and it was meant to serve as a reference value to determine fluctuations of the stock market. It first appeared in the Customer’s Afternoon Letter, a daily two-page financial news bulletin, which was the precursor to The Wall Street Journal later on also founded by Dow, which should become one of the most respected financial publications in the world.

The Son of a Farmer

The son of a farmer, Charles Dow became a journalist in Springfield, Massachusetts at the age of 21, three years later in Providence, Rhode Island. At the age of 29, Dow began compiling financial news for banks and brokerage firms at Kiernan News Agency in New York. Together with Edward Davis Jones and Charles Milford Bergstresser, he founded the financial news agency Dow Jones & Company in 1882 and published the first stock letter, the Customer Afternoon Letter, from which the Wall Street Journal developed.

A Four Day Field Trip

In 1879, Charles Dow and various tycoons, geologists, lawmakers, and investors set out on a four-day train trip to reach Colorado. Dow learned a great deal about the world of money on that journey as the men smoked cigars, played cards, and swapped stories. He interviewed many highly successful financiers and heard what sort of information the investors on Wall Street needed to make money. The businessmen seemed to like and trust Dow, knowing that he would quote them accurately and keep a confidence. Dow wrote nine “Leadville Letters” based on his experiences there. He described the Rocky Mountains, the mining companies, and the boomtown’s gambling, saloons, and dance halls. He also wrote of raw capitalism and the information that drove investments, turning people into millionaires in a moment. He described the disappearance of the individual mine-owners and the financiers who underwrote shares in large mining consortiums. In his last letter, Dow warned, “Mining securities are not the thing for widows and orphans or country clergymen, or unworldly people of any kind to own. But for a businessman, who must take risks in order to make money; who will buy nothing without careful, thorough investigation; and who will not risk more than he is able to lose, there is no other investment in the market today as tempting as mining stock.”

Working on Wall Street

In 1880, Charles Dow left Providence for New York City, realizing that the ideal location for business and financial reporting was there. The 29-year-old found work at the Kiernan Wall Street Financial News Bureau, which delivered by messenger hand written financial news to banks and brokerages. When John J. Kiernan asked Dow to find another reporter for the Bureau, Dow invited Edward Davis Jones to work with him. Jones and Dow had met when they worked together at the Providence Evening Press. Jones, a Brown University dropout, could skillfully and quickly analyze a financial report. He, like Charles Dow, was committed to reporting on Wall Street without bias. Other reporters could be bribed into reporting favorably on a company to drive up stock prices. Dow and Jones refused to manipulate the stock market.

The Wall Street Journal

In 1889, the company had 50 employees. The partners realized that the time was right to transform their two-page news summary into a real newspaper. The first issue of The Wall Street Journal appeared on July 8, 1889. It cost two cents per issue or five dollars for a one-year subscription. Dow was the editor and Jones managed the deskwork. The paper gave its readers a policy statement: “Its object is to give fully and fairly the daily news attending the fluctuations in prices of stocks, bonds, and some classes of commodities. It will aim steadily at being a paper of news and not a paper of opinions.”

The Dow Jones Industrial Average

Besides the railroad companies, which were the largest companies in the USA by that time, the two industrial companies (Pacific Mail Steamship Company and Western Union) were taken as highly volatile and speculative. Later on the composition of the Index changed, but remained with 12 companies in the first place. These original group of 12 stocks ultimately chosen to form the Dow Jones Industrial Average in 1896 did not contain any railroad stocks anymore, but purely industrial stocks. Of these, only General Electric currently remains part of that index. The other 11 were:

- American Cotton Oil Company, a predecessor company to Bestfoods, now part of Unilever.

- American Sugar Company, became Domino Sugar in 1900, now Domino Foods, Inc.

- American Tobacco Company, broken up in a 1911 antitrust action.

- Chicago Gas Company, bought by Peoples Gas Light in 1897, now an operating subsidiary of Integrys Energy Group.

- Distilling & Cattle Feeding Company, now Millennium Chemicals

- Laclede Gas Company, still in operation as the Laclede Group, Inc., removed from the Dow Jones Industrial Average in 1899.

- National Lead Company, now NL Industries, removed from the Dow Jones Industrial Average in 1916.

- North American Company, an electric utility holding company, broken up by the U.S. Securities and Exchange Commission (SEC) in 1946.

- Tennessee Coal, Iron and Railroad Company in Birmingham, Alabama, bought by U.S. Steel in 1907; U.S. Steel was removed from the Dow Jones Industrial Average in 1991.

- U.S. Leather Company, dissolved in 1952.

- United States Rubber Company, changed its name to Uniroyal in 1961, merged with private B.F. Goodrich in 1986, bought by Michelin in 1990.

The Twelve Most Important Shares

The Dow Jones Industrial Average was created by Charles Dow for the Wall Street Journal simply by adding together the prices of the twelve most important shares on the New York Stock Exchange and dividing the sum received by twelve. The initial quotation was 40.94 points on May 26, 1896. Between 1899 and 1902 Dow Editorials published an attempt to assign daily share price changes to a long-term trend. The summary of this became known as Lable Dow theory and basis of technical analysis.

Dow Jones Today

Today, the Dow Jones Industrial Average Index includes 30 large, publicly owned companies based in the United States that have traded during a standard trading session in the stock market. Along with the NASDAQ Composite, the S&P 500 Index, and the Russell 2000 Index, the Dow is among the most closely watched U.S. benchmark indices tracking targeted stock market activity.

Peter Lynch Lecture On The Stock Market | 1997, [7]

References and Further Reading:

- [1] Charles Dow at Britannica Online

- [2] Dow Jones History

- [3] Dow Jones Industrial Average at Wikidata

- [4] Reinhard Selten and Game Theory, SciHi Blog

- [5] Clarence Mackay connected the World, SciHi Blog

- [6] Charles Henry Dow at Wikidata

- [7] Peter Lynch Lecture On The Stock Market | 1997, Investor Archive @ youtube

- [8] “It All Began in the Basement of a Candy Store”. The Wall Street Journal. August 1, 2007.

- [9] Timeline of 19th century American Business People, via DBpedia and Wikidata

Good information regarding stock market trading, thanks for this information, . always share such posts to share such data.

MCX Tips

Thanks for your comment and also for sharing!